reverse sales tax calculator nj

New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This script calculates the Before Tax Price and the Tax Value being charged.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

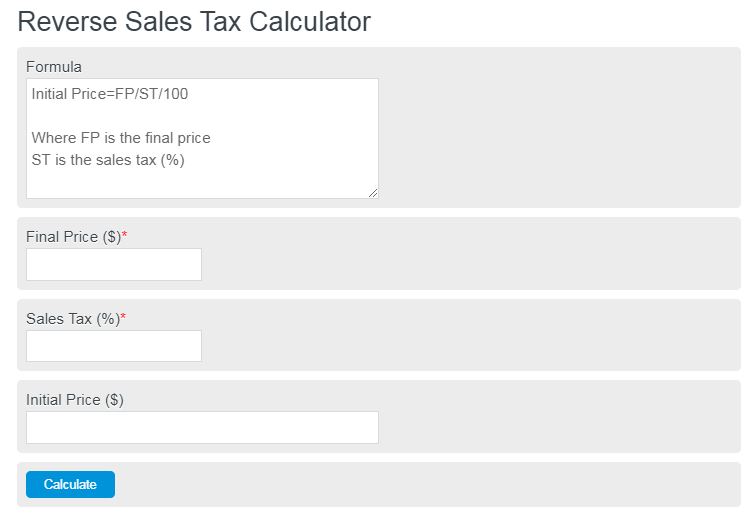

Instead of using the reverse sales tax calculator you can compute this manually.

. New Jersey has a single statewide sales tax rate. Input the Tax Rate. 1 0075 1075.

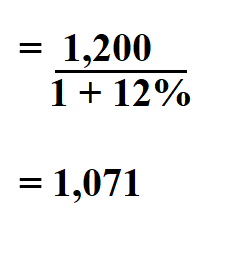

Please note state sales. Reverse Sales Tax Calculator Remove Tax. Here is how the total is calculated before sales tax.

What are the taxes and fees when buying a new or used car in new jersey. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. The flat sales tax rate means you will pay the same rate wherever you are in the state with two exceptions.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. As well as entrepreneurs and anyone else who may need to figure out just how much of their sale should be recorded as tax. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Following is the reverse sales tax formula on how to calculate reverse tax. New Jersey has a 6625 statewide sales tax rate and does not allow local governments to collect sales taxes.

New Jersey Sales Tax Calculator calculates the sales tax and final price for any New Jersey. Enter the sales tax percentage. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. Add one to the percentage. We can not guarantee its accuracy.

New Jersey Sales Tax Calculator Reverse Sales DrEmployee Source. If playback doesnt begin shortly try restarting your device. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

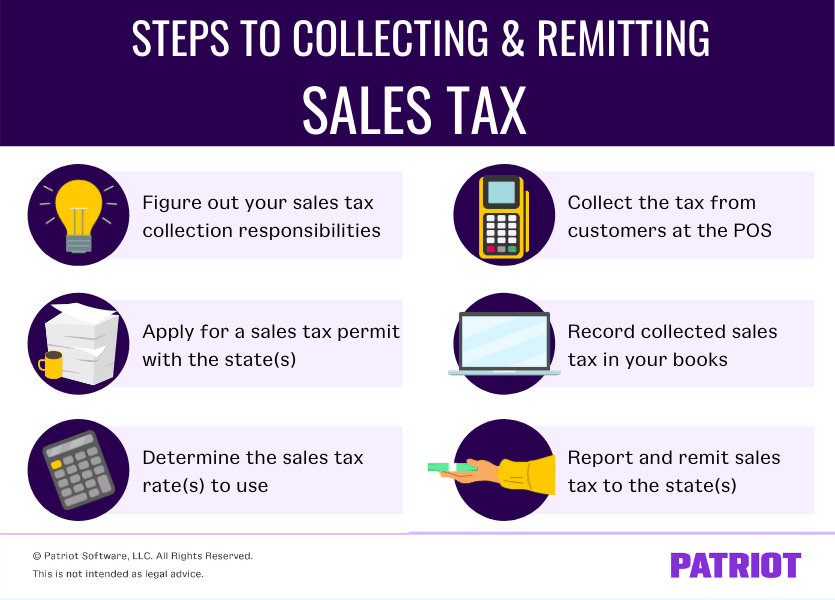

New Brunswick Newfoundland and Labrador. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. An aspect of fiscal policy.

How to File Sales Tax in New Jersey Taxify. There are times when you may want to find out the original price of the items youve purchased before tax. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service.

OP with sales tax OP tax rate in decimal form 1. Reverse Sales Tax Calculator - 100 Free - Calculatorsio. Divide the tax rate by 100.

That entry would be 0775 for the percentage. This app is especially useful to all manner of professionals who remit taxes to government agencies. Why A Reverse Sales Tax Calculator is Useful.

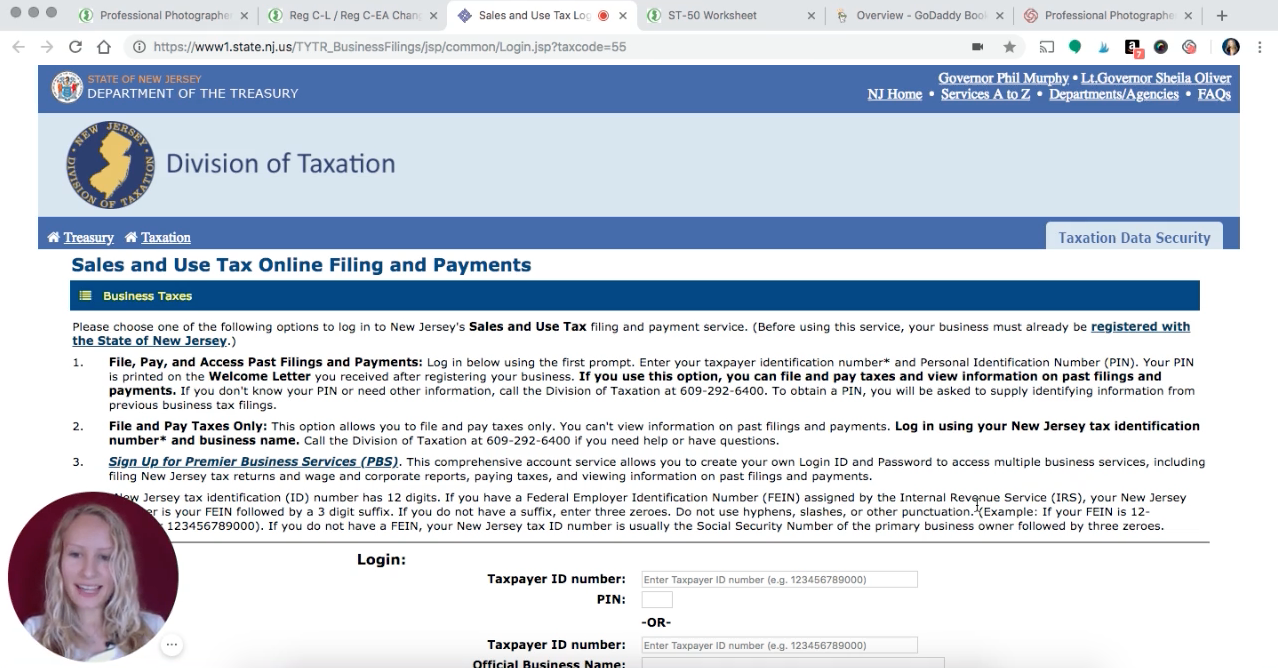

Sales and Use Tax. Canada Reverse GSTHST Calculator 2022. Order Now Offer Details.

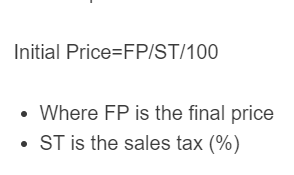

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Videos you watch may be added to the TVs watch history and influence TV. Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula.

To find the original price of an item you need this formula. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Jersey local counties cities and special taxation districts. Simply enter the costprice and the sales tax percentage and the NJ sales tax calculator will calculate the tax and the final price.

So divide 75 by 100 to get 0075. Amount without sales tax GST rate GST amount. Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation.

Overview of sales tax in Canada. The NJ sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. 55900 1075 52000. WOWA Trusted and Transparent.

Amount without sales tax QST rate QST amount. Divide the final amount by the value above to find the original amount before the tax was added. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

The base state sales tax rate in New Jersey is 6625. Find your New Jersey combined state and local tax rate. A tax of 75 percent was added to the product to make it equal to 55900.

New Jersey Sales Tax. 1 2018 that rate decreased from 6875 to 6625. How to Calculate Reverse Sales Tax.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Input the Final Price Including Tax price plus tax added on. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

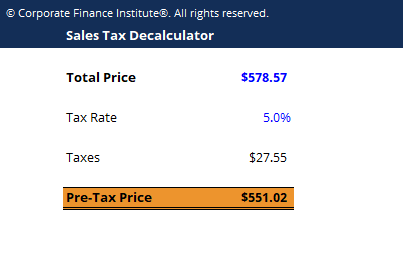

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Recovery Reverse Sales Tax Audit Pmba

New Jersey Sales Tax Calculator Reverse Sales Dremployee

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Reverse Sales Tax Calculator 100 Free Calculators Io

Avalara Tax Changes 2022 Read This Now Thank Us Later

Us Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Reverse Calculator Internal Revenue Code Simplified

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator De Calculator Accounting Portal

Collecting Nj Sales Tax As A Photographer Lin Pernille